Avoid the Category "Danger Zone"

If you're not leading your category or niche, you're in dangerous territory. Here's what the battle between Klaviyo, Braze, Iterable, and Cordial can teach you.

Here’s a good sign your brand might be in trouble.

Ask ChatGPT to write homepage copy for a typical product in your category. If the result sounds too close to what you’re using yourself, you’re at high risk of being seen as a commodity.

The B2C marketing automation space is a great example.

Which brand do you think this refers to?

____ lets you send automated, data-driven marketing campaigns across multiple channels using real-time personalization and AI-driven optimization. Our strong integration capabilities and powerful, user-friendly platform let you create seamless an experience and lasting customer relationships.

Klayvio? Braze? Iterable? Cordial?

The answer is “all of them.” And a few dozen other companies to boot. Take a look at any of their websites and you’ll see what I mean.

Klaviyo and Braze can get away with this (for now) because they have dominant positions for SMBs and enterprises (respectively). But players like Iterable and Cordial are in the category “danger zone.” They don’t lead a category or say enough to set them apart from everyone else.

That’s the lesson I want you to take away today.

Iterable and Cordial are in the category “danger zone.”

In this issue, I’m going to show you how to evaluate your brand’s narrative and find out if you’re at risk of becoming overlooked in a sea of sameness. To do that, we’ll take a look at the dynamics of this crowded category and then break down each brand’s narrative so you know what to look out for yourself.

2 Winners, 2 Brands Finding Their Path

There are dozens of players selling marketing automation tools for B2C companies. Some even offer customer data platforms, too.

I picked these four brands because they are all VC-backed companies that were founded between 2011 and 2014. Two of them already went public. Klayvio IPO’d in late 2023, and dominates the e-commerce / DTC space, especially among Shopify users. They’re now valued at around $10B.

Braze is more of an enterprise play and seems to have a strong position here. They went public in 2021 and their valuation today is around $4.3B. Both of these brands enjoyed a surge in business brought on by COVID, when there was a huge shift in spending towards e-commerce.

Each Company at a Glance

That leaves Cordial and Iterable.

Neither has reached the scale of its peers.

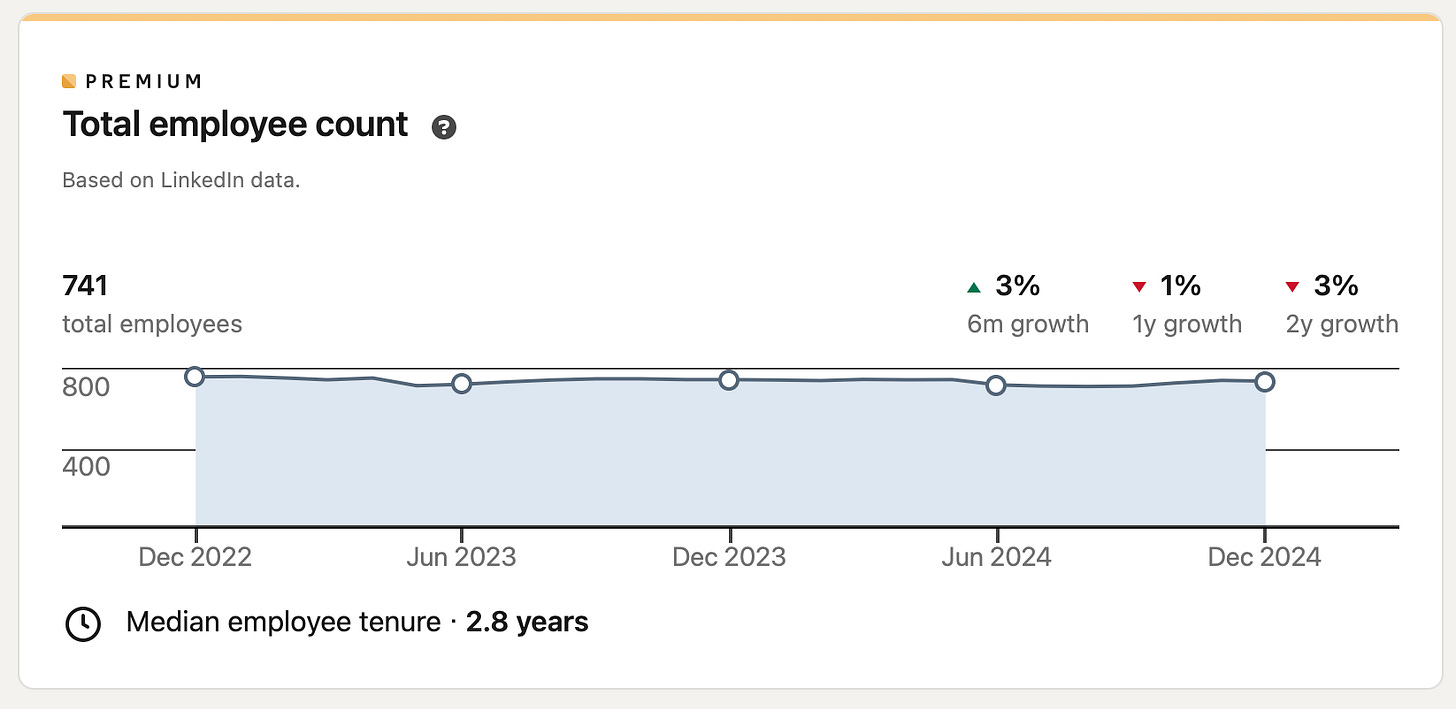

Iterable seems to be the most challenged. They’ve raised $342M, but employee growth has been flat over the last two years. That’s not a sign of growth. With their last valuation at $2B, they may be struggling to justify that valuation.

Cordial feels like the patient one.

They raised only $74M and have significantly fewer employees (about 250 vs 750 for Iterable.) Their valuation is unknown, but with a more conservative approach to funding, they may not have to scramble as much for growth. Employee count is up 30% over the last two years, and they just hired a new CMO.

Here’s what I think the category strategy for each brand is right now.

Klayvio is the king of the e-commerce / DTC space. Its job right now is to cement that position. They also may need to think about absorbing other categories (like returns software) and creating a meta-category.

Same story for Braze, but for enterprise.

Iterable and Cordial I don’t know. They’re not a clear leader of anything and they’re not a niche player either. If they don’t figure out a good category strategy, they risk being a “me too” player and demanding a poor acquisition price.

But Which of These 4 Brands Has the Strongest Narrative?

When I do these comparisons, I take a look at each brand on five metrics. I then give each one a rating. My evaluation is highly subjective, as an outsider looking in. But that’s the point. You shouldn’t need to consume tons of content or spend hours talking to sales just to get a sense of what a brand stands for.

Here are the criteria I use:

Point of View. Is there a unique take on the problem or solution?

Clarity. Is it obvious who the solution is for and what it does?

Strategic Alignment. Does the narrative get the right job done?

Memorability. Is it easy to remember what the brand stands for?

Distinctness. Are the claims made different from competitors?

You shouldn’t need to consume tons of content or spend hours talking to sales just to get a sense of what a brand stands for.

Point of View

Klaviyo: 4/10

Klaviyo is a beloved product. A lot of that came from its early focus on Shopify and making the exact product that e-commerce retailers on that platform needed. But if you look at their messaging today, it sounds too generic. There’s literally nothing you might strongly align or disagree with.

Braze: 6/10

Not perfect but the best of this group. Braze tries to make a distinction between “campaigns” and “conversations.” I like it any time a brand tries to reframe the job-to-be-done and this at least tells me they might think differently about their approach to marketing automation.

Iterable: 3/10

Iterable’s POV has something to do with solving an “activation gap” in data. But it feels incredibly dated. Saying that communicating with customers across “email, mobile, apps, social media, and texts” is “super complex” seems obvious at this point. Good POVs don’t state the obvious. If Iterable is going to become anything but a “me too” offering, then it needs something much stronger.

Cordial: 4/10

Cordial isn’t much better, but there’s a hint that a “lack of understanding” is a pain point for marketers. It’s not called out directly, but their website promises to help you understand customers better. It would be interesting to see what could happen if they pulled on that thread more.

🏆 Winner: Braze

Clarity

Klayvio: 8/10

I like how Klaviyo continues to call out retail and DTC businesses as a primary customer, even as it’s expanded beyond that. It’s pretty clear what it does: it’s a marketing automation and unified data platform. While there are a few too many buzzwords, the examples of how Klaviyo works are pretty straightforward.

Braze: 5/10

If Braze is enterprise-focused, why do they say “made to scale with companies of all sizes”? That’s a confusing message that lacks conviction on who they serve best. However, there is a greater emphasis on security and compliance, which enterprises care about more. They’re trying to differentiate by calling themselves a “customer engagement platform.” But what is that? We’re never told.

Iterable: 4/10

What do Jersey Mike’s Subs, Airtable, and The Athletic have in common? Not much. Iterable literally sells to everyone. Not a great look when you’re not the leader. “The marketing platform to activate your data with ease,” tells you nothing more than “this is a marketing platform.”

Cordial: 6/10

ChatGPT told me that Cordial is supposed to be more enterprise-focused, but I didn’t see that come across – at least not explicitly. The mention of a services offering implies that they focused on the larger end of the market, but it doesn’t do much to tell an enterprise “This is made for me.”

🏆 Winner: Klavio

Strategic Alignment

Klaviyo: 7/10

Klaviyo is the only one who acts like a category king: “Klaviyo vs. the world. Basically, there’s no comparison. But you can compare anyway.” If you’re the leader, this is the kind of claim you should make to lock in your position. They still fall into the trap of feature comparisons, though, which elevates attention to competitors unnecessarily.

Braze: 4/10

My hypothesis with Braze is that it needs to own the enterprise space to make sure it’s distanced from Klaviyo. But even its homepage video says that it’s the “best in class customer engagement platform” for “customers of all sizes.” That’s too broad of a claim to be credible. And there isn’t much to show how Braze is thinking about the future.

Iterable: 1/10

I can’t discern a specific category strategy from Iterable. As I said before, it feels too much like the average of everyone else’s narrative.

Cordial: 3/10

Like with Iterable, I can’t find anything that shows me how the brand is different from the status quo or driving the space forward. If they have a high-touch offering, we aren’t shown why that might be so important to their customers. Almost like they assume customers know why they would need this.

🏆 Winner: Klaviyo

Memorability

Klaviyo: 3/10

This is one brand that deserves a good tagline, but unfortunately, owned language is Klaviyo’s weak spot. While they got good marks for clarity, they haven’t given you much to latch onto.

Braze: 5/10

There are two words the Braze could own: “conversation” and “engaging.” But they aren’t surfaced enough to stick in your head. That’s an untapped opportunity.

Iterable: 3/10

Other than the “activation gap” statement, there is no unique language introduced by Iterable. Look away and there’s nothing to remember.

Cordial: 6/10

The word “understand” is used several times on the home page. There’s even a subdomain understand.cordial.com. This is good! They just need to lean on this more to drive it home.

🏆 Winner: Cordial

Distinctness

Klaviyo: 8/10

“157,000+ brands in 80+ countries grow with Klaviyo.” That’s pretty own-able. So is “350+ integrations.” If you want the most widely-used platform, then you don’t need to think super hard.

Braze: 6/10

Is their AI offering truly the “the world’s smartest marketing advisor”? The problem is, that’s a hard claim to back up. I did stumble across this one, which feels more substantial: “Braze operates with sub-second latency—not batch-and-blast—so you can generate the right engagement in the right moment to yield the most valuable results.” But the brand doesn’t talk about the need for speed anywhere else.

Iterable: 3/10

They’re more explicit about their claims, but they aren’t all that unique: “AI-powered, Built for Data, Easy to Use, Open, and Flexible” are things most anyone could say.

Cordial: 5/10

“Send a better message” is something anyone could say. But Cordial is the only brand in this group that makes claims about doing the work for you (through its services offering). I don’t know how important this is to its customers, but it is a claim they have all to themselves.

🏆 Winner: Klaviyo

Overall Winner: Klaviyo

Here’s how the overall scores stacked up:

Klaviyo: 30/50

Braze: 26/50

Iterable: 14/50

Cordial: 24/50

🥇Overall Winner: Klaviyo

While Klaviyo might have edged out the others, it’s not a slam dunk.

This is good news if you’re someone besides them because it leaves the door open for someone with a meaningful (and radical) difference to carve out their own territory.

That being said, here’s what I would do if I were working with each brand.

Klaviyo Must Braze Must Strengthen Their Position; Iterable and Cordial Need to Find Their Path

Buyers tend to do one of two things: they buy from the market leader because it’s the obvious choice that won’t get them fired, or they choose a niche solution that does something others can’t match.

Klaviyo and Braze lead their respective spaces (for now). Yet both brands lack clarity on their POV. And since their platforms are so feature-rich, their content gets down into the weeds very quickly.

As their offerings expand, both need to think about what they can do to avoid the “platform for everything” problem that so many SaaS companies run into. You can’t just pile on features without giving customers a high-level narrative of what the platform is (and why you should use it over point solutions).

By the way, ZoomInfo is an example of what happens when you don’t do this.

Meanwhile, the job to be done for Iterable is unclear.

I think they could be at risk of becoming a “zombie” startup: a company that raised its last round at too high a valuation, and can’t find the growth to justify it. They haven’t conveyed anything to demonstrate why someone should buy from them over anyone else, especially since their POV sounds like it was written a decade ago. Maybe they are cheaper? I hope that’s not their only strategy.

I’m more curious about what Cordial will do.

Their services offering is intriguing, especially if that’s something enterprise buyers need and can’t get elsewhere. And the “understanding” angle has promise, but there needs to be something on the product roadmap that backs that up. But this could be a good way for them to avoid playing feature wars. Based on what I know, that’s where I’d start.

Lead or Niche, but Don’t Fall in the Middle

Buyers tend to do one of two things: they buy from the market leader because it’s the obvious choice that won’t get them fired. Or they choose a niche solution that does something others can’t match. Either strategy is a good place to be.

It’s the middle that’s dangerous.

That’s where Iterable, Cordial, and dozens of other solutions sit at the moment. The sooner they clarify their strategy, the better.

How about you? Do you already own your category or a niche within it? Or are you floating in a sea of sameness? Check out The 6 Category Strategies for some guidance on where to go next.

Thanks for reading. I run a strategic narrative consultancy called Flag & Frontier. I help clients align their executive teams around their narrative and win their category.

Find out more about working with me by booking an intro call.

You can also say hello on LinkedIn 👋.

Cheers,

John